Real Estate Terminology

A

Abutting

Abstract of Title

Adverse Possession

Advertising Costs

Agent

Agents Fees

Amortisation

Appraisal

Auction

Average Household Size (AHS)

B

Balloon Payment

Balloon Payment

Benefit-Cost Ratio (BCR)

Body Corporate

Bond Clean

Built to Rent

C

Capital Gain

Capital Growth

Clear Title

Collateral

Conveyancing

Covenant

D

Decrement

Developer

Dual Occupancy

Dummy Bidding

E

Easement

Economic Obsolescence

Electrical Inspection

Enduring Power of Attorney

Expressions of Interest (EOI)

F

G

Gated Communities

Gazumped

Gearing

Gross Rental Yield

H

I

J

L

Land

Lease

Leverage

Lien

Lowball Offers

LVR - Loan to Value Ratio

M

Mortgage

Mortgage Indemnity Insurance

Mortgage Offset Accounts

Mortgage - the case why you should pay it off

N

Negative Gearing

Neighbours

Non Tax-Deductable Debt

O

Open House

Option Fee

Over Capitalised

P

Pool Inspection

Pre Paid Building Inspection

Principal

Property Management Fees

Property Styling

Property Trust

R

Rates

Repayments

Rental Yield

Restrictive Covenant

S

Second-Tier Locations

Settlement

Standards

Strata Levies

T

Tenant

Timeshare

Time Value of Money

V

Vendor Bidding Vendor bidding is an acceptable practice used by a seller to make sure the property reaches its reserve price. With vendor bidding, the identity of the person making the bids is announced by the auctioneer at the commencement of the auction and each time a bid is made. Vendor bids must not continue once bidding for the property has reached its reserve price.

Abutting

Properties that share common boundaries.

Abstract of Title

A short version of the full history of title to a property. This is sometimes called a title extract or extract of title.

Adverse Possession

If after 20 years (12 years in SA) of occupying another's land, that person's ownership rights are extinguished. The reason for this is that land is valuable and if it is not looked after, the law is not very sympathetic to this.

Advertising Costs

Advertising costs for your home can either be paid by you or included in agents commission costs. You have more control if you are aware of the precise costs for advertising.

Websites are increasingly a key factor in advertising - large real estate websites will charge substantial fees to real estate companies on a monthly basis. It is recommended to ask your agent how effective their company website is - can properties be found in local searches - in fact you could do some searches on keyterms and see which agents sites come up and use that to choose your agent because unless they are paying hefty monthly fees for their website this is going to find prospective buyers more cheaply than any other form of advertising. You may avoid paying for newspaper ads when marketing your property.

Some of the largest real estate websites are owned by media companies who generate substantial income from real estate advertising.

Real Estate Agents can use an SEO to increase site rankings. Often they will also have listings with large sites like RealEstate.com.au

Ask your agent for details or an advertising schedule of where your money is being spent.

Agent

A person or broker employed to buy or sell a property. Fees and commissions are usually paid by the vendor.

Qualities of a Good Agent

- they always have time for you and return you calls

- they know the suburb really well

- they can supply recent vendor references

- they have an honest reputation

- they allow you to make the decisions but actively assist in the process

- they are a skilful negotiator

Agents Fees

If you are terminating your agent you must do this properly - usually you must give notice. Don't go to another agent until you have terminated your agreement or you could be up for two fees.

Agents fees are negotiable especially if another company offers a percentage less. Note if they negotiate well on their commission it may be an indication of how they will perform with potential buyers.

Real estate agent commissions can be as low as 1% or as high as 4.5%. The average commission rate in Queensland is around 2.7%.

We now have Fixed Fee Real Estate Agents in Australia after companies like UK Purple Bricks have started up in Australia.

Amortisation

To pay off your debt by regular instalments over a period of time.

Appraisal

The amount that an appraiser says your property is worth. Be wary of an appraisal report supplied by the current owner or agent acting for the owner.

Auction

You need to prepare before buying a home at auction by knowing your legal rights and requirements. These can differ from state to state in Australia. It is also useful to attend a few auctions first to see how they work.

Average Household Size (AHS)

Average household size (AHS) "the average number of adults and children living in a home" is a key determinant of underlying demand for housing.

A new measure of AHS using Labour Force Survey data is a timely measure.

Balloon Payment

A large lump sum paid at the end of a loan to clear a debt.

Bank Valuation

A bank's estimate of the property value, which is often conservative.

Benefit-Cost Ratio (BRC)

The benefit-cost ratio (BCR) is a ratio used in a cost-benefit analysis to summarise the overall relationship between the relative costs and benefits of a proposed investment or project. BCR can be expressed in monetary or qualitative terms. If a project has a BCR greater than 1.0, the project is expected to deliver a positive Net Present Value (NPV) to the investor. NPV is used in capital budgeting and investment planning to analyse the profitability of a projected investment or project.

Body Corporate

Generally for units where there are multiple owners. A Body Corporate manages the ongoing expenses and day to day running of the building. They may pay for building insurance ground upkeeps etc. With different States in Australia having differing rules for body corporates it is often useful to employ professional body corporate management.

Body Corporate changes in Queensland

A State Government body corporate law which allowed penthouse owners to pay the same annual maintenance fees as unit owners on lower floors is aggravating some owners of units. Southport MP Peter Lawlor has been highly critical of the new legislation and will hold a public rally in the park at Evandale at 10am on Sunday, June, 15 2008.

Many Gold Coast bodies corporate are subject to the new law, derived from what is known as the Centrepoint case. It enables penthouse owners with floorspace that is four times that of residences on lower floors to pay the same annual body corporate fee.

As a result, the fees for smaller unit owners have in some cases been doubled, while the levy for penthouse owners has halved.

There are a number of cases of unit owners being forced to sell their properties because their body corporate fees had skyrocketed.

Update: The contributions levied on the owner of each lot must be based on the contribution schedule lot entitlements, unless the legislation says otherwise. This is essentially an allocation based on the size of units. The contribution schedule lot entitlements are listed in the community management statement recorded for the scheme.

Bond Clean

Residential Tenancies and Rooming Accommodation Act 2008 provides for a checklist of items to be cleaned in order for the tenant to get a bond back when renting.

Built to Rent

Build to Rent is a term used to describe property that is specifically developed for long-term rentals

This is a new model compared to the typical real-estate development involving sales to individual owners or individual investors.

Build to Rent is common in the US and also growing in the UK.

Capital Gain

Capital gains tax (CGT) is the tax that you pay on any capital gain you make and include on your annual income tax return. It is not a separate tax, merely a component of your income tax. You are taxed on your net capital gain at your marginal tax rate. This would apply to the sale of an investment property.

Capital Growth

Capital Growth is the appreciation (or negative return) of the asset itself expressed as a percentage %.

Clear Title

Land that does not have any liens debts against it, including a mortgage.

Collateral

Assets that secure a loan.

Conveyancing

If you want to buy or sell a home, land or investment property you'll have to sign a contract. The legal work involved in preparing the sale contract, mortgage and other related documents, is called conveyancing.

Conveyancing work can be done by-:

- use a licensed conveyancer

- use a solicitor

- do it yourself

Covenant

An agreement by one party to adhere to certain terms, conditions or restrictions regarding a property. A covenant is not usually valid unless noted on the title to the land. The nature of the covenant should always be established and the question asked: What effect will this covenant have upon the future plans for the property?

A lawful restriction on the use or improvements permitted on a property.

Decrement

A decrease in a properties size. This could be caused by erosion on a creek, river or beach.

Developer

A company or person who purchases a property to redevelop it and sell for a profit. In Australia some developers are cause for concern especially in fragile ecologies like the Gold Coast. In fact Gold Coast residents have joined together to form Save our Spit to fight against developers who try to influence governments to develop public open space at the Gold Coast Seaway.

Dual Occupancy

A block of land or existing dwelling which is zoned in a way which allows the owner to erect a building which has two distinct living arrangements (for example, a duplex or a house with a granny flat attached).

Image courtesy Capitl Dual Occupancy Specialists

Dummy Bidding

"Dummy bidding is when an agent or a person acting on the vendor's behalf pretends to be genuinely interested in purchasing a property by making bids at an auction. When dummy bids continue after the reserve price has been reached, the genuine bidder is competing with a false buyer and is pushed to pay as much as they can. Unless the dummy bidding is fully disclosed at both the start of the auction and at the time the bid is made, it is likely to be considered misleading and therefore unlawful."

source: ACCC

Easement

A right to use all or part of the land owned by another for a specific purpose. Your property may border a river or creek and may therefore have an easement to allow Council workers access.

Economic Obsolescence

A fall in your property value due to factors out of your control. For example when a rubbish dump is built next door.

Electrical Inspection

Many state electrical bodies eg Electrical Safety Office (ESO Queensland) are now recommending pre-purchase electrical inspections conducted by qualified electricians for home purchases.

Enduring Power of Attorney

Written authorisation for one person or person(s) to act legally on behalf of another. A person may become incapacitated or sick and require someone else to make financial and legal decisions on their behalf.

Expressions of Interest EOI

An expression of interest campaign allows buyers to submit their best offer on a property before the closing date. The seller (vendor) does not have to commit to a sale.

Fixture

Items such as hot water systems, built-in cupboards, bath, stove, etc. That cannot be removed from a property without causing damage.

Gated Communities

Restricted access to a fenced off development or mini-suburb.

Gazumped

Gazumped is where an agent who is supposed to help you buy an asset buys it themselves. This may occur through a shelf company or third party.

Gearing

Negative Gearing occurs when you borrow to invest in an income producing asset and the cost of borrowing exceeds the returns (income) from that asset.

Negative gearing on a rental property, for instance, occurs when the annual interest payable on the loan used to acquire the property, plus other expenses incurred in maintaining the property, exceeds the annual rental income the property generates.

Positive Gearing occurs when you borrow to invest in an income producing asset and the returns (income) from that asset exceed the cost of borrowing.

Refer A History of Gearing in Australia

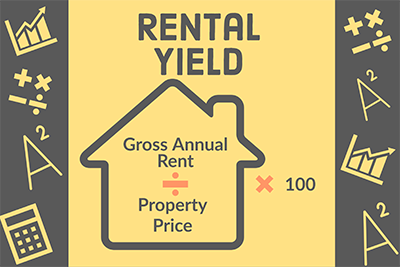

Gross Rental Yield

Gross Rental Yield The gross annual rental income, expressed as a percentage of property purchase price. This is what a landlord can expect as return on his investment before taxes, maintenance fees and other costs.

Home Equity Loan

A Home Equity loan could be a line of credit account secured by a first registered mortgage over your residential property.

Investment Property

Many investors will negative gear a property.

Purchasing a property for the permanent rental market, has its merits. Currently there is high demand for rental properties in Australia.

Holiday rental is a viable alternative - you could purchase a property and achieve high returns by placing it on a Holiday Rental website like Gold Coast Accommodation online.com. The benefits of this is you can holiday in your apartment/house and get to enjoy it yourself. The holiday rental market is very strong in popular location like the Gold Coast.

Interest

When someone lends money to someone else, the borrower usually pays a fee to the lender. This fee is called 'interest'. 'Simple' interest, or 'flat rate' interest. The amount of simple interest paid each year is a fixed percentage of the amount borrowed or lent at the start.

Compound Interest is Interest which is calculated not only on the initial principal but also the accumulated interest of prior periods. This is sometimes referred to as the miracle of compound interest.

Joint Tenants

Joint Tenants can mean two things:-

1 Where two people are written onto the contract and if you passed away the other would inherit your share automatically no matter what you state in your will. (so be careful here!)

2 Where two or more people equally share the rent and responsibilities.

Land

The Australian Definition of Land is generally- "The giant carrot definition":

Whatever the surface holder owns they have up to the heavens and down below the Earth.

EXCEPTIONS- Mines and Minerals are owned by the State and air space is limited to what is reasonably needed to make use of the surface.

Lease

A verbal or written document granting possession of a property for a given period without conferring ownership. The lease document specifies the terms and conditions of occupancy and rent payable.

Avoid signing leases around Christmas as it can be very hard to find a tenant around 1st December to the 1st of February.

Leverage

When you borrow money to purchase an investment to magnify the rate of your profits from

a capital growth

b your income from the investments

Inventors often leverage one property to purchase another

Tip - borrow only what you can afford in a worst case scenario.

Lien

In law, a lien is a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation. A monetary claim against a property.

Lowball Offers

In tough times like the GFC of 2009 many investors will offer very low offers for properties just to test the waters. These are referred to as Lowball Offers. Although you may be tempted, try to avoid putting the investor offside - often they are wanting to see if there is a reaction in the hope of sniffing out a bargain. There is no necessity to put in a counter offer. You can use your agent to respond to avoid offending these investors.

LVR - Loan to Value Ratio

Loan to Value Ratio is the amount of the loan divided by the purchase price (or appraised value) of the property. This figure is used to access whether Mortgage Insurance is required.

"If your LVR is higher than 80%, you will usually need to pay lender's mortgage insurance, and the lender could charge you a higher interest rate. Avoid these extra costs by saving a bigger deposit to lower your LVR".

source ASIC

Mortgage

A temporary, conditional pledge of property to a creditor as security for performance of an obligation or repayment of a debt.

Remember to negotiate your mortgage - many banks in Australia will negotiate.

Mortgage Indemnity Insurance

Your credit provider can insist you take out or pay the cost of types of insurance specifically allowed by law. These are compulsory third party personal injury insurance, mortgage indemnity insurance or insurance over property covered by any mortgage. Otherwise, you can decide if you want to take out insurance or not.

Mortgage Offset Accounts

Suncorp (and most banks) have a system as follows:-

If you had $10,000 spread over three sub-accounts, and $100,000 owing on your linked home loan, you would only be charged home loan interest on $90,000. And, because interest is calculated daily, you benefit every day by keeping your income and savings in Everyday Options sub-accounts.

Offset accounts are great security giving you access to funds in an emergency.

Check if there are any charges for drawing from your Offset account.

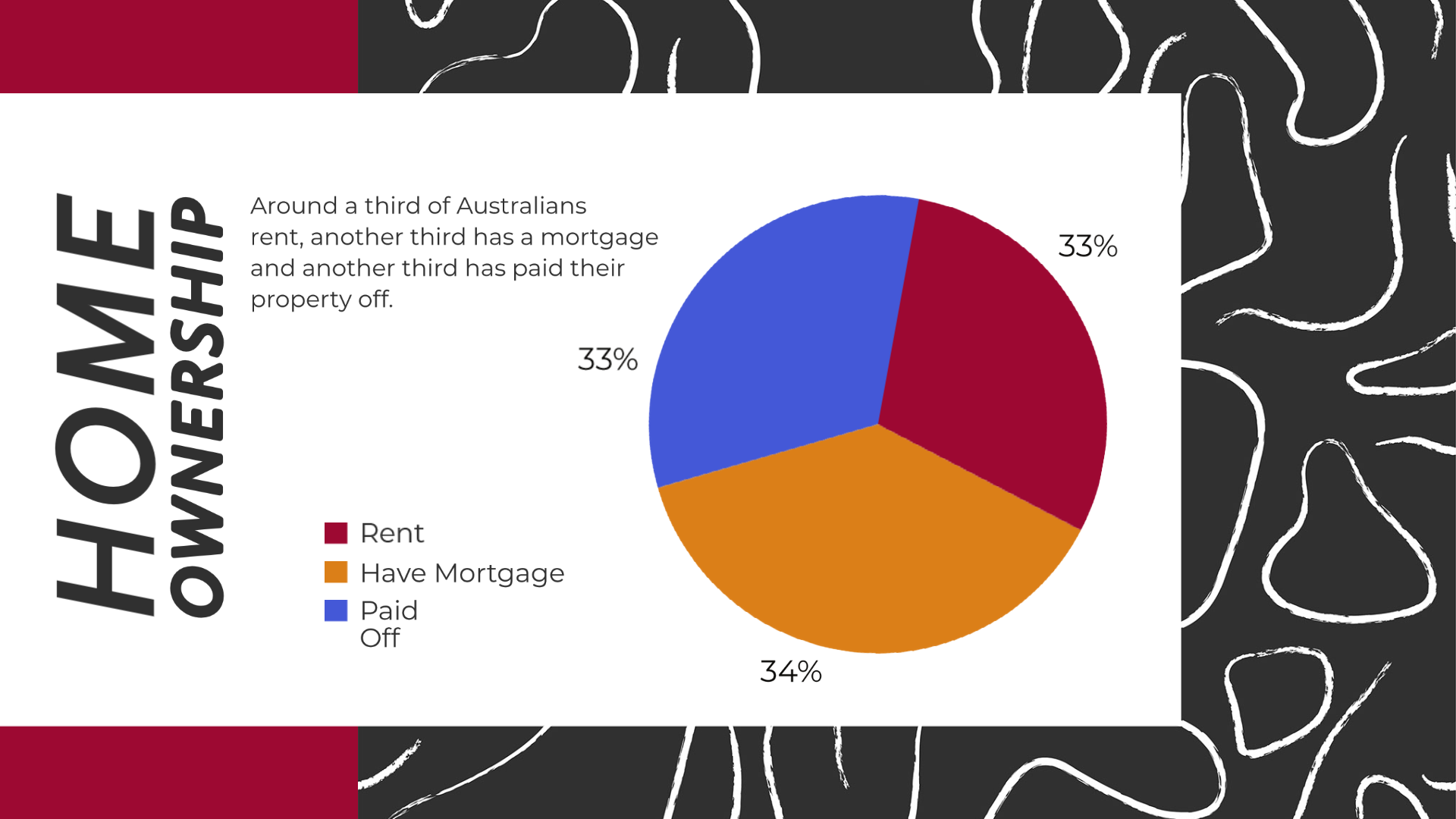

Interestingly relatively few people in Australia (approx 33% per ABC news 2022) do have a mortgage on their home.

Mortgage - the case why you should pay it off

If you have a home loan forget about other investment opportunities waved in front of you and pay it off.

Paying off your mortgage gives you a risk free after-tax return equal to your mortgage rate.

Paying off a 7 per cent mortgage is like getting a pre-tax return of 13 per cent for investors on the 46.5 per cent tax rate. The expected long-term rate of return on Australian shares is 10.2 per cent.

from Financial Review April 9 2011.

Negative Gearing

In Australia, negative gearing usually refers to borrowing to buy a residential investment property (house, unit, etc) which is rented out. Almost everywhere rents are less than interest on property value, leading to negative gearing if the investor borrows say 80% or 90% of the cost. Loans of up to 100% are even possible.

Negative gearing is a form of financial leverage where an investor borrows money to buy an asset, but the income generated by that asset does not cover the interest on the loan. (When the income does cover the interest it is called positive gearing.)

Australia allows investors from all over the world to own property. Many investors by properties on the Gold Coast. If you are planning a trip to Australia to view the properties check Gold Coast Accommodation for places to stay and maps of the Gold Coast and visitor information. South East Queensland is Australia's fastest growing area.

Neighbours

One of the most important aspects of purchasing a home is neighbours. Real-estate agents will show you the house at the best time of day for gaining a sale. Check the area at various times and days to ensure you are not moving next door to the "neighbour from hell". Developers interested in Amalgamation of Strata-titled Lots for Development may buy up units and deliberately put in "neighbours from hell" to force remaining owners to sell.

Non Tax-Deductable Debt

Non Tax-Deductable Debt is debt like credit card debt that are not able to be claimed as a tax deduction.

Open House

An Open House is when a real-estate agent opens up your house for an inspection for prospective buyers. It may only be open for an hour or two. This is often used as a lower pressure sales technique to achieve a sale.

Option Fee

A deposit you offer a real estate agent to hold an option period that allows you to consider your purchase without others being able to purchase the property. If you do not purchase the property this option fee is paid to the vendor.

Over Capitalised

You may have paid such a high price or over renovated so that the property is either worth a lot more than other similar properties in the area or worth a lot more than you can recover.

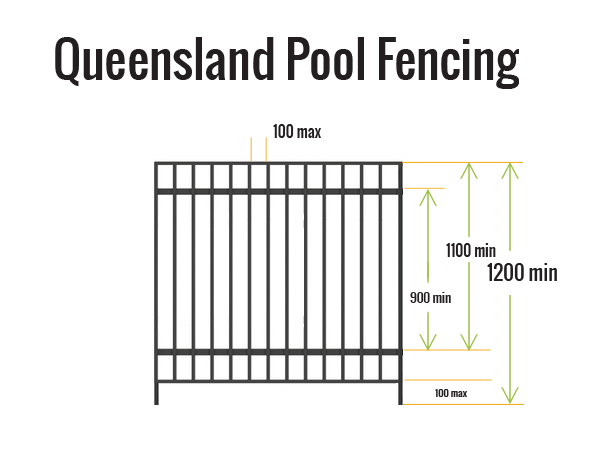

Pool Inspection

A pool inspection is required in many jurisdictions in Australia. The rules that apply depend on the state. One area that is strictly controlled is around pool fencing.

Pre Paid Building Inspection

It is best to get an independent Building Inspector (not one supplied by or regularly used by an agent) when required to do so. Lloyd Woods recommends qualified inspectors with building experience. He will often give a realistic estimate of costs for renovations whilst providing an inspection. There is no requirement for inspectors to have building experience.

Principal

Principal is the amount you borrow. Check our financial calculators and see that principal is the first entry. Every payment you make on your home loan reduces this principal.

Property Management Fees

Property Management Fees are fees charged by Real Estate agents to manage your property. Generally there is a 7% fee charged by agents in Australia.

Often a fee for finding a tenant is equal to one weeks rent.

Some agents charge a fee for preparing leases and other costs like photocopying, postage etc.

Property Styling

Property Styling is often applied to either an unfurnished house or to a furnished one to make it look more presentable.

This can create a vision that puts the buyer into a better frame of mind to purchase.

Some property styling companies have their own furniture pieces or hire them for the auction or inspection.

Property Trust

Unit trust which invests unitholders money in real estate. Different trusts specialise in various areas of real estate (commercial, retail, industrial or residential). There can be good long term returns from well managed property trusts.

Rates

Rates refers to the annual, quarterly, half-yearly or monthly payments made to local shire councils for amenities like water, sewerage and garbage collection. There may be other levies for improvements to parks and roads.

Council Rates are a form of property taxation and property values play an important part in determining how much each individual rate payer contributes. There has been the situation where the rise of property values has forced the owner to sell their house as they cannot afford the council rates.

Repayments

A Repayment is an estimate of the minimum repayment you need to pay to pay off your home over the full term of the loan.

Why only an estimate?

Because small errors creep in that make the payment inaccurate especially with leap years and changes to monthly fortnightly or weekly payments.

Rental Yield

If you have a property worth $500,000, your tenant pays $25,000 per year in rent and you pay $5,000 a year in costs, you have a gross rental yield of 5%, and a net rental yield of 4%.

Restrictive Covenant

A promise to refrain from doing something. This can be enforced against a third party.

Second-Tier Loculations

Sounds too good to be true - probably is. What some investors call second-tier locations are locations where a developer has bought up and placed dense set of units. Sometimes these are fitted out poorly and can be possibly in inner city locations. Hence they sound good however are not as desirable as the well crafted ads would indicate.

Settlement

Settlement is where you exchange contracts keys money etc. associated with the sale of an asset (property). This is stress time because missing the deadline can cost you in bank fees or vendor compensation. All parties need to be present with all documents. You are allowed to celebrate when this goes well as you are now the new owner.

Standards

Standards set out specifications, procedures and guidelines that aim to ensure products, services, and systems are safe, consistent, and reliable. They cover a variety of subjects, including consumer products and services, the environment, construction, energy and water utilities et cetera.Strata Levies

Strata levies can vary widely depending on the age and condition of the building and facilities. In high rises the maintenance of a lift can add to the cost of the levies. These levies can be anywhere from $ 300 - $ 3000 per quarter.

Tenant

The person who helps you pay off your property. In Australia most tenants go to real estate agents to find themselves a place to live or do business.

Timeshare

Just Don't! The high pressure sales techniques used plus the lack of any real ownership or ability to sell your purchase make these a poor investment choice.

In the early 1980s, bikini-clad women and white-shoe salesmen confronted people on the streets of Surfers Paradise.

Potential victims were offered free gifts to lure them to a heavy-duty sales pitch for a product presented as a cheap way to buy real estate. In the trade, this grab-em method was known as "body snatching".

New government regulations are likely to stop the deceptive methods for attracting timeshare buyers have apparently stopped the industry.

Parliamentary Joint Committee on Corporations and Financial Services  481 kb Timeshare: the price of Leisure September 2005.

481 kb Timeshare: the price of Leisure September 2005.

If you really want a holiday on the gold coast go to a Gold Coast Accommodation website and book one.

Time Value of Money (TVM)

A financial concept: money in the present is worth more than the same amount of money to be received in the future.

FV=PV(1+i)n

Vendor Bidding

"Vendor bidding is an acceptable practice used by a seller to make sure the property reaches its reserve price. With vendor bidding, the identity of the person making the bids is announced by the auctioneer at the commencement of the auction and each time a bid is made. Vendor bids must not continue once bidding for the property has reached its reserve price."

source: ACCC