What Returns could I make from Property Investment

With an investment property there are 2 distinct sources of measuring Return on Investment (ROI), rental yield and capital growth.

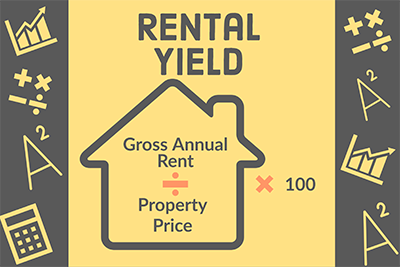

Rental Yield

If you have a property worth $500,000, your tenant pays $25,000 per year in rent and you pay $5,000 a year in costs, you have a gross rental yield of 5%, and a net rental yield of 4%.

For example in 2020 RealEstate.com calclulated the average rental yield across 10 Gold Coast suburbs-:

| Avg. Rental Yields Gold Coast | |

|---|---|

| Surfers Paradise | 3.28% |

| Miami | 4.1% |

| Jacobs Well | 4.59% |

| Worongary | 5.2% |

| Mt Tamborine | 4.61% |

| Clear Island Waters | 4.04% |

| Arundel | 5.13% |

| Ashmore | 5.11% |

| Broadbeach Waters | 3.74% |

| Mermaid Beach | 2.69% |

Source: best suburbs to invest in Gold Coast (RealEstate.com.au)

Note COVID 19 has affected these numbers on the Gold Coast. Fox's Real Estate Agents Southport Gold Coast report a serious lack of availability of properties, both for rent and sale.

Capital Growth

Capital Growth is the appreciation (or negative return) of the asset itself expressed as a percentage %.

If say you bought a unit at Main Beach on the Gold Coast for $125,000 in 1991 what would be the price now 2021 (30 years) if you gained a 10% pa Capital Growth on average?

| Capital Growth $125,000 30 years | |

|---|---|

| 5% | $540,242.80 |

| 6% | $717,936.40 |

| 7% | $951,531.88 |

| 8% | $1,257,832.11 |

| 9% | $1,658,459.81 |

| 10% | $2,181,175.28 |

Which suburbs deliver over the long-term?

You may see a better overall return from a property with a lower rental yield and a higher capital growth.

| Price to Income Ratio | ||

|---|---|---|

| Sunshine Coast | 4.45 | |

| Gold Coast | 9.66 | |

Refer Sunshine Coast vs Gold Coast

Commercial Rentals

Check the rental history

Always check to see if rents are not fasely inflated, or there is not a history of arrears. You can check the rental payment register.

With a good tennant and a long-term lease rental returns can be better than the residential market.

Commercial Rental Tips

- Buy at the right time in the right industry

- Location - a small regional town may have a higher rental yield and a smaller capital growth over time.

- Buy an asset that is easy to re-let

- Research your asset - don't pay too much

- Commercial properties need a larger deposit - often 30%

SEARCH ARTICLES

Recent Posts

- Jul, 22, 2025

- May, 6, 2025

Diversity on Boards

- Apr, 11, 2025

When does asbestos become dangerous in your home?

- Jan, 23, 2025

How Design Aesthetics Shape Perceived Value

- Dec, 10, 2024

Impact of Inflation on First-Time Buyers

- Nov, 4, 2024

How to understand and check your credit score

- Sep, 19, 2024

Buying off the plan? Beware of sunset clauses

- Jul, 5, 2024

Essential Workers Explained

- Jun, 13, 2024

Ozone Generators to remove Mould

- Feb, 19, 2024

Massive tax handouts for property investors

- Feb, 16, 2024

Body Corporate sinking fund - QLD

- Feb, 2, 2024

Scaffolding Safety

- Sep, 20, 2023

Learning to Negotiate

- Jul, 11, 2023

Pension Age Rises to 67

- May, 18, 2023

Becoming A Registered Builder In Australia

- Apr, 17, 2023

Forced Sales - Queensland - 75% Rule

- Dec, 6, 2022

Petty Landlords & Negative Gearing

- Sep, 19, 2022

The benefits of shade sails for your home

- Jul, 27, 2022

Termite Swarmers Season

- Jun, 22, 2022

Fear of missing out driving inflation

- Apr, 28, 2022

Australia's Rental Crisis

- Mar, 7, 2022

Should you buy a home with Termite damage?

- Mar, 3, 2022

Tactics to reduce body corporate disputes

- Jan, 25, 2022

Globalisation - The Hedgehog & The Fox

- Nov, 2, 2021

Revealed: Top 10 areas to avoid buying

- Oct, 28, 2021

Is that house protected against termites?

- Sep, 15, 2021

Tree Changers & Sea Changers

- Aug, 12, 2021

COVID 19 and Body Corporate Responsibilities

- Jul, 29, 2021

Tenants beware of rental rewards schemes

- Jun, 25, 2021

Sunshine Coast versus Gold Coast

- Jun, 23, 2021

Your superannuation and your home

- Jun, 11, 2021

How many properties sit empty?

- May, 4, 2021

Real Estate Agents and Property Managers

- Apr, 20, 2021

Why You Need A Termite Inspection

- Mar, 19, 2021

SEO for Real Estate websites

- Mar, 18, 2021

Three Reasons Why Your Home Needs Data Cabling

- Mar, 16, 2021

Smoke Alarms: What you need To know in QLD

- Dec, 10, 2020

Pre-purchase Electrical Inspection

- Dec, 4, 2020

Why should I drink Adelaide Hills Wines?

- Aug, 26, 2020

Amalgamation of Strata-titled Lots for Development

- Jul, 28, 2020

Adelaide Hills a unique region

- Apr, 28, 2020

Ozone Generator in Your Home

- Apr, 21, 2020

Air conditioning cleaning

- Apr, 14, 2020

Housing Affordability in Australia

- Apr, 6, 2020

Security Systems

- Mar, 31, 2020

Termites and protecting the home

- Feb, 27, 2020

Printing for the Real Estate Industry

- Nov, 12, 2019

Beware of Property Investment Spruikers

- Oct, 31, 2019

Prices for Home Alarm Monitoring

- Oct, 9, 2019

House and Land packages best investment

- Oct, 1, 2019

The 'Scourge' of Underquoting

- Oct, 16, 2017

Professional Pest Control

- Sep, 29, 2017

Built in Wardrobes

- Jul, 9, 2015

Pool Inspections Queensland

- Jun, 25, 2015

Negotiating your purchase with the Inspection

- May, 12, 2015

DIY Move or hire a removalist company?

- Nov, 19, 2014

Why are housing prices rising faster than wages?

- Jan, 17, 2014

The Friendliest Real Estate Agents

- Jul, 23, 2013

A thorough Building and Pest Inspection

- Sep, 28, 2012

How to Compare Home Loans

- Jan, 25, 2012

Southport Real Estate