Petty Landlords & Negative Gearing

The Crises in Australian Rental Housing and Home Ownership

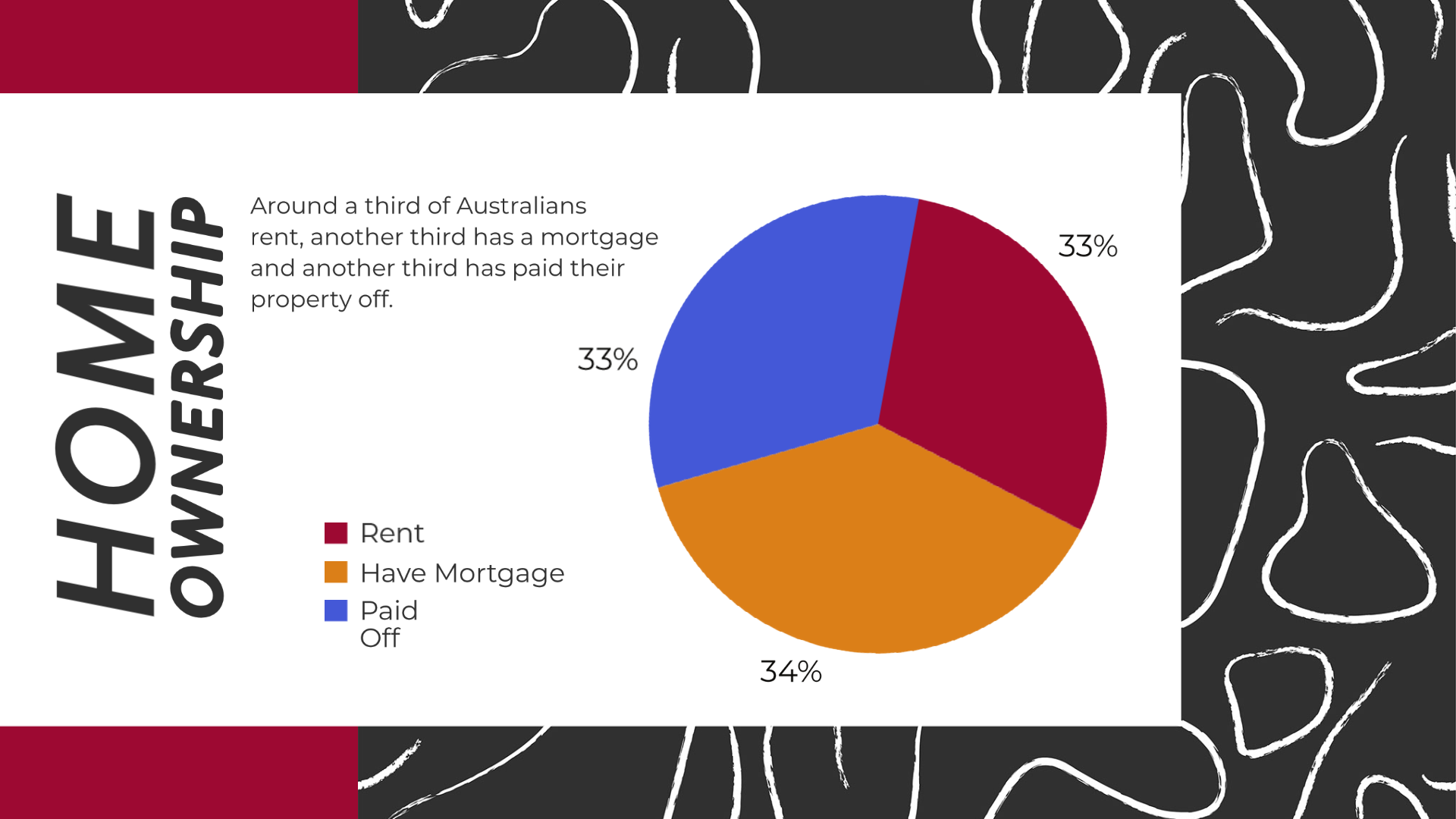

One of the great Australian dreams is to own our own home. A major issue facing Australians today is "housing affordability", especially for first home buyers.

By 2015, one in every seven Australian taxpayers owned a rental property. First home buyers found themselves competing with investors, who were utilising Australia's negative gearing laws.

Negative Gearing has existed in Australia since 1922, where a property investor is allowed to claim losses on their 'investment' against their taxable income, thus making investing attractive. Negative gearing began as a way to encourage housing construction.

Foreign investors attracted to the Australian Real Estate market have also helped to push house prices up to unprecedented levels, especially during the peak of the Global Covid-19 pandemic during 2020-2021.

Housing affordability is now out of reach for many Australians, especially first home buyers.

Those in the private rental market have also suffered sharp rises in rent and insecurity with tenancies agreements during a ten year period of wage stagnation, combined with recent sudden hikes in inflation and the cost of living in Australia. Rental Rewards schemes have also adversely affected some tenants.

In a recent radio broadcast ABC RN presenter, Keri Phillips, invited independent urban and regional planning and housing policy experts to give their perspectives on the Australian housing and rental crises (13/11/22).

https://www.abc.net.au/radionational/programs/rearvision/rear-vision/14099486

While interest rates have been at historical lows, Jago Dodson, Professor of Urban Policy and Director of the Centre for Urban Research at RMIT University, points out:

Since the mid-1980s, we've stopped building public housing and shifted to a highly de-regulated market-driven housing system which benefits existing asset owners over those who don't have assets.

Foreign 'Investors'

The situation has been exacerbated by the ease with which cashed-up foreign 'investors' can enter the Australian Real Estate market to 'land bank' properties with the capital gains they are speculating on amassing as property prices continue to soar, often due to the highly inflated prices these investors are willing to pay to get a foot into the Australian property market.

Melbourne is currently the most in demand city in Australia for property searches from India, United Kingdom, China and Singapore. Since international borders re-opened in January 2022, searches for properties to buy are up 31% and searches for rental properties are up 97% as rents continue to reach record highs...

(from S. Carbines. Herald-Sun, 20 November 2022 & Proptrack. Overseas Search Report, November 2022)

Local and foreign developers have also been successful in 'convincing' Local Governments to change planning laws to allow them to amalgamate the titles of existing detached-homes and strata-titled unit blocks in order to construct high-rise, high density 'luxury apartment' and 'penthouse' developments that they (falsely) claim will alleviate the current 'housing crisis'.

Gold Coast Housing

The development industry is particularly adept at using the above 'housing crisis' PR spin in Queensland where the State Government has directed the City of Gold Coast to plan for housing supplies to cater for an increase in its current population of approximately 650,000 to 1 million by 2041 under State Government growth targets.

However, the cost of renting these 'luxury apartments and penthouses' currently being constructed on the Gold Coast involves exorbitant weekly rental prices, well above previous market rates for affordable rental properties.

Many of the new owner/landlords pitch their 'luxury' accommodation to high paying short-term vacationers and Airbnb clients, so as to claw back their often inflated purchase price and to cover their expensive perpetual 'body-corp' fees for the service and maintenance of elevators and shared 'luxury' amenities such as rooftop pools, gymnasiums etc.This tactic does nothing to cater for current and future housing shortages on the Gold Coast.

As a consequence, property and apartment prices have also been forced up beyond the reach of most middle and low income Australians trying to enter the home ownership market for the first time or attempting to find affordable long-term rental housing.

And those wanting to move to places like the Gold Coast to fill the labour shortages in the aged and healthcare sectors and education, tourism and hospitality industries are unable to move to the Gold Coast because of prohibitively high rental costs and home purchase prices.

According to the Real Estate Institute of Queensland, the Gold Coast's rental vacancy rate has fallen from a high of 5.2 per cent in June 2011, to 0.6 per cent in September 2022.

By mid-2022, the median rent for a Gold Coast house rose 40% when it reached $868 a week — up by $248 since 2019, while the median Gold Coast house price was $875,881, a 32 per cent jump over the previous 12 months.

The total number of rental listings on the Gold Coast is the lowest it has ever been according to new data from CoreLogic and long-term rentals are being turned into short-term holiday stays over the Christmas period.

Exacerbating the rental situation, it is estimated up to 20% of new Gold Coast apartments are sitting vacant as investments. These vacant properties are held for long-term capital gains by investors, resulting in a major reduction in the availability of Gold Coast rental properties to households.

Deep into 2022, the Australian housing affordability crisis continues to worsen as wages remain stagnant and interest rates, inflation and the cost of living continue to climb.

National Housing Accord

In recognition of the growing housing affordability and rental market supply crises, Federal Treasurer, Jim Chalmers, unveiled a National Housing Accord in the newly elected Labor Government's first budget in October 2022.

Dr Chalmers revealed the accord's "ambitious but achievable" aims that include the construction of a million "well located" properties over five years from 2024.

(from Finn McHugh, Canberra Times, 25 October 2022)

The Federal Government claims that they are committed to working with States and Territories, Local Governments and private investors to reshape housing in Australia with a joint commitment to also building fifty thousand social and affordable homes.

Social Housing

In the past, the term 'social housing' described public housing owned and operated by the State. Dodson maintains that social housing includes both community and public housing and was typically rented at a ratio of 25-30% of Tenant income.

Social housing was generally targeted at those individuals and households in the greatest social distress who were on low incomes, such as pensioners or other forms of welfare income.

Community housing was more often targeted to different client groups with specific forms of housing to meet particular needs, such as supported housing for people with disabilities.

During the 1990s,10% of all Australian housing construction as a proportion of housing stock was social housing. Over the past 20 years social housing has been scaled back to only 2% of all housing construction.

Nicole Gurran, Professor of Urban and Regional Planning, University of Sydney, exposes the previous Federal L-NP Coalition government as having invested in only 2-3,000 social/affordable houses per year. Prior to the L-NP coming to power in 2013, previous Federal governments invested in the construction of 10-15,000 social/affordable houses per year.

Gurran claims there are currently 150-170,000 Australians on the waiting list for social housing.

Affordable Housing

According to Dodson, the term 'affordable housing' refers to housing that is priced at a rate below the prevailing market rate given the type and location of the dwelling. Affordable housing may be owned and operated by a charitable or non-government organisation that reduces its tax burden through its charitable status.

Affordable housing rental rates tend to be closer to 70-80% of Tenant income or more commonly, slightly more than 70-80% of the current market rate that the dwelling would command under the private rental market. Affordable rental housing is mostly targeted at clients such as low income tenants whether they be welfare recipients or low income workers.

To be effective, social and affordable housing must be well located in relation to public transport, potential workplaces, shops, schools, childcare and medical/hospital facilities.

Since the 1990s, Pawson maintains that in addition to Government housing-policy failings, regulations in Australia have also failed to ensure that the private market was delivering enough low-cost housing:

House price inflation has so dramatically outpaced wages growth, house prices have literally "gone through the roof."

H. Pawson. ABC RN 13/11/22

Australian Housing History

Dodson charts the years immediately after World War 2 when the Australian Government assisted in housing "not only for low income renters but low income buyers as well."

State Housing Commissions were initially set up to build large numbers of social housing dwellings but from the 1950s onwards they switched to building dwellings for sale into the private housing market.

A huge increase in the quality and volume of dwellings in Australia during the post-war period saw a massive increase in home ownership and an increase in the public housing sector that coincided with a decrease in the private rental sector.

At the conclusion of World War 2 in 1945, only 52% of Australians owned their own dwelling and the remainder lived in the private rental sector.

Over the next 20 years Australia increased the proportion of households who were homeowners by 20%, so by the early 1970s, 72% of households were homeowners.

This was probably the largest expansion of mass public welfare in the history of Australia with that facilitation of home ownership.

J. Dodson. ABC RN 13/11/22

Delaying Home Ownership

Dodson points to statistics that reveal between the 2016 Census and 2021 Census there has been a slight increase in the number of households who are home occupiers during a period of historically low borrowing interest rates.

However, households are delaying home ownership and taking longer to pay off mortgages compared with 20 to 40 years ago, "but eventually catch up later in life and in their late-60s…"

Delaying home ownership, leading to paying off mortgages much later in life brings its own kind of financial, social, physical and mental stresses and health issues. Households in this situation are more likely to forgo necessary medical attention (with its associated costs) in order to ensure they keep up their mortgage repayments. This can lead to chronic and/or life threatening physical and mental illnesses not being treated in a timely manner.

These households may also sacrifice their family's educational, recreational, vacation and social opportunities into their late 60s when the mortgage is finally paid off.

Apart from the mental stress this causes, members of these households a vulnerable to acquiring addictive behaviours such as alcohol, drugs and gambling to compensate for their lack of disposable income to enjoy the healthier activities mentioned above, thus putting greater financial, health and mental stress on the household and the State.

And given Australian households are remaining in the private rental market for much longer than previous generations, Dodson claims renters run the risk of being,

subjected to the anxieties and prejudices of petty landlords who [currently] make up the majority of private rental lettings in Australia.

Private rental is a very insecure tenure, the average lease is about 9-12 months in Australia and [renters] are subject to the whims of the market in terms of rental cost increases.

Real issues in terms of housing policy are more likely to lie in the regularity of the private rental market than providing additional support for home ownership.

(ibid)

Hal Pawson, Professor of Housing Research and Policy at UNSW, refers to the Productivity Commission's recent findings that 170,000 Australian households are left with less than $250 per week after they paid for the 'roof over their heads'.

The Australian Census reveals that during the 1990s the number of low income private renter households was under 50,000. In 2020, low income private renter households exceeded 200,000.

The latest Rental Affordability Index (RAI) released on 29 November 2022 shows rents are escalating faster than household incomes across the country, prompting New Daily reporter, George Hyde's headline:

'Super anxiety-inducing': Rents are a national crisis with Hobart worst in the country

(G. Hyde. New Daily, 30 November 2022)

Since 2016, the median rental rate in Hobart has grown by 60 per cent. It is now 11 per cent higher than the Melbourne median, despite the average rental household income being 18 per cent lower than Melbourne incomes.

RAI has also revealed that regional areas have been the hardest hit. The worst affected states are Queensland, Tasmania, and Western Australia. The regional areas of Queensland and Tasmania are now at their most unaffordable in the period measured by the RAI.

However, Pawson claims:

We don't have an overall housing shortage but rather a shortage of housing rental that is affordable.

H. Pawson. ABC RN 13/11/22

Suicide Prevention Australia (SPA) revealed:

Housing affordability and cost of living/debt have substantially increased since 2021, becoming two of the top three risk factors.

from https://apo.org.au/sites/default/files/resource-files/2022-09/apo-nid319402.pdf

SPA noted a stark increase in the number of people with suicidal ideations due to housing affordability and availability with Queenslanders more at risk than most other Australians. Cost of living and personal debt remain the number one concern.

(from Jackie Sinnerton. GCB, 12/12/22)

Rental Housing Regulations

Pawson maintains that Australia has relatively light regulation of private rental housing compared to other countries.

The balance of rights between landlords and tenants is quite heavily weighted towards owners rather than renters, a tradition similar to most Anglophile countries (including the UK and others).

...because of the way our housing system has changed over recent decades, the set up for private rental housing is no longer appropriate… More people are renting for longer periods of their lives or in perpetuity as life-long renters.

H. Pawson. ABC RN 13/11/22

Pawson points to countries like Scotland and New Zealand where the government has "modernised the residential rental framework in a significant way", especially by increasing tenant security.

The most important part of this modernisation lay in creating a system where a landlord doesn't have unlimited power to end a tenancy and "a tenancy can only end for specified reasons that are stated in law."

This means that the level of security for a tenant is not absolute but it is significantly increased. No longer can a Landlord simply use the threat of eviction if a tenant is exerting their right to have urgent repairs sorted out.

(ibid)

In 2021, the Victorian Labor Government introduced a set of reforms to private rental regulations that "substantially emulate what Scotland did in 2015."

Employers Invest in Essential Worker Housing

It is well documented that key workers in fields such as education and healthcare find it difficult to rent in the communities they serve.

As a response, Demographics Group (Melbourne) co-founder, S. Kuestenmacher, is currently advising major employers of health, education and hospitality staff to build or subsidise affordable rentals for their employees in a return to a model used during Europe's industrial revolution 200 years ago, to ensure access to staffing:

For employees, the approach makes them more competitive without increasing wages, and money spent buying or building housing will likely have financial returns as property values rise.

Australian superannuation funds are also beginning to invest in the construction of residential apartment towers "where key workers, including nurses, teachers and emergency services personnel can rent at as much as a 20 per cent discount to the market rate."

(from Nathan Mawby. Herald-Sun, 27 November 2022)

The model of an employer providing or constructing nearby affordable housing for employees is not new to Melbourne where it was first successfully tried in 1906.

Case Study - Sunshine

Industrialist H. V. McKay founded the Sunshine Harvester works, an Australian factory manufacturing agricultural equipment, when he moved his established agricultural implement works and many of his employees from Ballarat to Braybrook Junction in 1906, where he had earlier purchased the struggling Braybrook Implement Works.

McKay named his new factory the Sunshine Harvester Works after his highly successful agricultural product, the 'Sunshine Harvester'.

H.V. McKay aspired to create the "Birmingham of the future". By 1910, the Sunshine Harvester Works was employing 1,300 workers and had given its name to the surrounding suburb, that was renamed from Braybrook Junction to Sunshine. By the 1920s McKay's factory employed over 3,000 workers and covered 76 acres (30.7 hectares), making it the largest manufacturing plant in Australia

https://collections.museumsvictoria.com.au/articles/2735

McKay also invested in the construction of houses for his employees near to his factory. This included, enabling workers to buy houses through affordable loans from the company and the use of facilities such as tennis courts, cricket grounds, gardens and a church. The employees also lived in tree-lined avenues and had electricity supplied by the Sunshine factory.

McKay's Sunshine Estate is considered a pioneering development of a company town based on the town planning principles of the 'Garden City Movement'. The principles of the Garden City movement were first developed in England by Ebenezer Howard in 1898.

[McKay] drew inspiration from overseas company towns, notably those of Cadbury and Lever brothers in England. His own estate department built stores, a public hall and library, and a coffee palace, provided land for a technical school, supplied electric light and public gardens, and initiated tree planting.

If there were an element of idealism, Sunshine was nevertheless an investment in industrial peace. McKay anticipated that married men, preoccupied with family, mortgage repayments and their gardens, would prove a loyal, diligent, and politically moderate workforce.

At Ballarat he had introduced generous holiday leave, a contributory accident fund and a personal loan scheme; these were extended at Braybrook under the management of worker committees…

Critics saw not so much philanthropy as subtle social and industrial controls.

https://adb.anu.edu.au/biography/mckay-hugh-victor-699

In 1925, McKay's pioneering 'employee housing scheme' attracted the following compliments:

If a cluster of outer suburbs could be ringed around Melbourne, all planned and developed with the prescience and system that has been exercised in Sunshine, there would be no grounds for fearing the growth of new slums that now haunt many once-promising districts. Sunshine today illustrates how pleasant and secure life can be made when a powerful industrial concern undertakes the housing of its employees [sic].

- Australian Home Builder (1925)

Home Ownership

Dr Laurence Troy, senior lecturer in the School of Architecture, Design and Planning at the University of Sydney, suggests our whole housing model is deeply embedded in our social model in Australia:

If we say home ownership is not for everybody, we need to be addressing those downstream welfare impacts of people who can't get into home ownership or don't want to get into home ownership.

We don't want a big tranche of disadvantaged people… reaching retirement and suddenly thrown into poverty because they have to pay rent in a market setting which is unaffordable against a pension.

L. Troy. ABC RN 13/11/22

Julie Lawson, Adjunct Professor at the Centre for Urban Research at RMIT University and lead author of the UN Study, Housing 2030, refers to Finland as a successful model for creating affordable home ownership, especially for young families in Finland:

Right to occupancy housing in Finland is where you own about 15% of the dwelling and the rest of it you rent at a much reduced rate. The equity in the dwelling gives you a sense of security. It also offers you a form of saving that can grow over time and keeps pace with cumulation of land and housing values as a saving mechanism.

J. Lawson. ABC RN 13/11/22

Nicole Gurran cites Singapore:

80% of Singaporean households are living in housing constructed by the Singapore Housing agency. And that housing is provided across a range of different housing products that are always very well located.

The whole [housing] infrastructure is around making sure households are able to access the housing product they can afford and they are able to access over time…with very strong Government involvement in the planning, financing and building of homes.

N. Gurran. ABC RN 13/11/22

ABC Radio RN presenter, Keri Phillips suggests that the Australian Government is unlikely to follow the Singapore Government's example and that the "Housing Accord is only a modest, if positive, development."

However,the current Victorian Labor Government is leading other States and the Federal Government with its announcement in 2020 of a $5.3bn "big housing build" to fund 12,000 new social and affordable homes in four years.

[Victoria] is also hoping to increase homeownership in the state by tripling the size of its Victorian Homebuyer Fund to $1.1bn. The fund allows homebuyers to purchase with a 5% deposit, with the government providing up to 25% of the purchase price of the home.

Homebuyers can then buy out the government's share at market value over time, with payments reinvested to help others enter the property market.

(from B. Kolovos. The Guardian. 25 October 2022)

Renters' Paradise

While long-term and lifetime renters continue to increase as a proportion of Australian households, the construction company Mirvac is currently adopting a build-to-rent model for rental housing that has been in operation in the USA and UK for the past 10-15 years where it has been popular.

Tenants have an indefinite lease, are not required to pay a bond and are permitted to redecorate and change the paint colours of their apartment. Tenants claim it is like renting but they treat the apartment as if it's their own place.

A Melbourne "build to rent" tower was unveiled by Mirvac in December 2022. The 490 apartment building is adjacent to the Queen Victoria Market in central Melbourne and has been called a "renters' paradise" by tenants.

Mirvac's "LIV Munro" offers a variety of apartment options from studios to 3 bedroom apartments and pets are allowed.

https://www.livmirvac.com/

Tenants are able to transfer units to upsize and downsize throughout their tenure and have access to 24 hour desk service.

Apartments come with all whitegoods, around-the-clock maintenance and replacements.

(from Peter Rolfe. GCB, 8/12/22)

In the upmarket build-to-rent housing models, tenants have access to facilities such as swimming pools, ballet and yoga studios, a wellness centre, entertainment spaces and co-working facilities.

The 39-storey build-to-rent LIV Munro building is the second such tower to be built in Melbourne, following the launch of the 59-storey "Home" tower on Southbank in August 2022. Mirvac are planning on providing 5000 build-to-rent apartments in two new Melbourne locations by 2030.

At the moment the build-to-rent model of rental housing does not necessarily fall into the 'affordable rental housing' category with unfurnished studio apartments in the "Home" building starting at $595 per week rental rate.

However, if a more basic model without the swimming pools, yoga studios etc was offered by private build-to-rent developers, a greater supply of low-to-moderate cost, non-luxury rental apartments could be supplied to rental market.

Carol Viney, the newly appointed head of fund manager Super Housing Partnerships says,

Developers and build-to-rent [BTR] operators can invest profitably in affordable rental housing and give up no margin compared with premium BTR investment...

Carol Viney Super Housing Partnerships

HESTA CEO, Heather Blakey, agrees with Viney:

Developments with a range of housing types lowered the [financial] risk...

The mixed-tenure approach is expected to provide investors diversification benefits, with a smooth income profile, stable rental income, low vacancy rates and high demand that is less exposed to economic downturns..

(from Michael Bleby. Financial Review, 01/02/23)

Build-to-Rent-to-Buy

Another model being trialled in Melbourne to better facilitate affordable home ownership is the build-to-rent-to-buy concept. For example,

Residents sign a 5-year lease with the option to purchase their home for a fixed price at the end of the term.

The purchase price is agreed up front and is calculated as the current price with fixed 1.75 per cent increases per year over 7-years (2 years of construction + 5 years of leasing).

The lease and option to purchase is secured by paying a refundable amount of 1 per cent of the purchase price prior to the start of construction (e.g. $5k for a $500k apartment).

Over the 5-year lease period, residents are supported with not-for-profit financial coaching services and bulk-buying initiatives to leverage economies of scale.

After five years, residents can exercise the option to purchase the property at the fixed price, with the 1 per cent refundable amount contributing towards the purchase price.

from https://www.koalainvest.com.au/post?post_id=3472

The 'build-to-rent' and 'build-to-rent-to-buy' models are in stark contrast to what is (mostly) occurring in the private 'residential' development industry throughout much of the rest of Australia.

This is especially the case on the Gold Coast, Queensland, where 'assetisation' dominates the residential housing construction landscape.

Assetisation

A global process called financialisation or assetisation of housing has emerged in Australia where homes are valued more for their money making potential than for their foundational use as a source of shelter.

Pawson claims 'assetisation' is a major contributor to a lack of housing affordability in Australia, leading to delayed home ownership or households caught in a lifetime of private renting.

Those who don't already own a property or aren't lucky enough to inherit some equity are left behind.

We have… a growth in the number of people who are renting privately who are facing retirement in the rental sector, so now more than a third of Australian households rent.

Government has ceased to invest in any sustained way in government supported social and affordable housing.

H. Pawson. ABC RN 13/11/22

Negative Gearing

Dodson insists, Australia needs a change to the way the tax system effectively subsidises private landlords through negative gearing that allows landlords to deduct the costs associated with their properties from taxable income.

Over the last 3 years the interest burden for landlords has been very low but with interest rates going up we'll start to see landlords writing off interest payments at higher levels. So the tax concession of negative gearing is going to become more costly over the next few years. It's currently looking at about $8 billion.

Dodson asks the questions the government has avoided addressing:

Are we getting good value in putting $8 billion of tax concession into a highly unregulated, opaque, low accountability, petty landlord sector?

Should we be taking that effective subsidy and crafting it in different ways so that we get much better outcomes?

The 2022 YouGov polling on suicide prevention revealed important community insights.

The third highest "emerging suicide risk" (just behind 'Cost of Living/Personal Debt' and 'Social Isolation/Loneliness') was 'Housing Access and Affordability'.

Respondent views in the YouGov survey regarding the interventions needed to tackle emerging suicide risks associated with housing access and affordability included:

- More social and affordable housing needs to be built and current stocks need to be revitalised.

- Early intervention for people on rentals who have a rental increase.

- Remove negative gearing

from https://apo.org.au/sites/default/files/resource-files/2022-09/apo-nid319402.pdf

Dodson suggests there are various ways negative gearing could be turned into a private rental subsidy where landlords are required to target particular tenant groups, setting minimum quality standards for the dwelling and turning it into a low income housing tax credit where they have to invest in a given institutional housing project rather than an individual dwelling.

Or we could say "no more negative gearing". We're going to take that [$8 billion] and put it into public or social housing.

Dodson concludes that the issue we are going to have to deal with is the continued subsidy of the petty landlord who writes off the cost of investment at great expense to the public purse through negative gearing:

We need to go beyond that if we are going to have a just and equitable housing system in the future

J. Dodson. ABC RN 13/11/22

Perhaps only then will Federal Treasurer Jim Chalmer's well-intentioned National Housing Accord have a fair chance of success.

Researched, compiled, composed, written & edited by Dr Steve Gration - November 2022.

References and Resources

Bleby, Michael. 'Affordable housing offers same returns as commercial build to rent'. Financial Review, 1 February 2023.

Carbines, Scott. Property search record. Online spike drives more rental crisis pain. Herald- Sun, 20 November 2022.

Churchward, M. and Dale-Hallett, L.The Sunshine Harvester Works, Sunshine, Victoria, Australia, 2007.

https://collections.museumsvictoria.com.au/articles/2735

Hyde, George. 'Super anxiety-inducing': Rents are a national crisis with Hobart worst in the country. 30 November 2022.

https://thenewdaily.com.au/finance/consumer/2022/11/29/rental-affordability-australian-cities/

Koala Invest. Build-to-Rent-to-Buy Model

https://www.koalainvest.com.au/post?post_id=3472

Kolovos, Benita. 2022 budget: Jim Chalmers delivers national housing agreement to build 1m homes. The Guardian. 25 October 2022.

Lack, John. McKay, Hugh Victor (1865-1926). Australian Dictionary of Biography, Volume 10 , 1986.

https://adb.anu.edu.au/biography/mckay-hugh-victor-699

McHugh, Finn. Canberra Times, 25 October 2022

https://www.canberratimes.com.au/story/7955278/landmark-accord-to-tackle-housing-crisis-sets-million-home-target/

Mawby, Nathan. Home is where the job is. Herald-Sun, 27 November 2022.

Mirvac. Build-to-Rent

https://www.livmirvac.com/

Murray, Nieves. SP Australia CEO. State of the Nation in Suicide Prevention - A survey of the suicide prevention sector. Suicide Prevention Australia, September 2022.

https://apo.org.au/sites/default/files/resource-files/2022-09/apo-nid319402.pdf

Phillips, Keri. National Housing Accord - one million new homes promised. ABC Radio RN (13/11/22) with:

Dodson, Jago. Professor of Urban Policy and Director of the Centre for Urban Research, RMIT University

Gurran, Nicole. Professor of Urban and Regional Planning, University of Sydney

Lawson, Julie. Adjunct Professor at the Centre for Urban Research at RMIT University. Lead author of the UN study, Housing 2030.

Pawson, Hal. Professor of Housing Research and Policy at UNSW

Troy, Dr Laurence. Senior lecturer in the School of Architecture, Design and Planning at the University of Sydney

https://www.abc.net.au/radionational/programs/rearvision/rear-vision/14099486

Proptrack. Overseas Search Report, November 2022

Sinnerton, Jackie. Housing crisis causing distress. GCB, 12 December 2022.

SEARCH ARTICLES

Recent Posts

- Jul, 22, 2025

Who is responsible for that water leak?

- May, 6, 2025

Diversity on Boards

- Apr, 11, 2025

When does asbestos become dangerous in your home?

- Jan, 23, 2025

How Design Aesthetics Shape Perceived Value

- Dec, 10, 2024

Impact of Inflation on First-Time Buyers

- Nov, 4, 2024

How to understand and check your credit score

- Sep, 19, 2024

Buying off the plan? Beware of sunset clauses

- Jul, 5, 2024

Essential Workers Explained

- Jun, 13, 2024

Ozone Generators to remove Mould

- Feb, 19, 2024

Massive tax handouts for property investors

- Feb, 16, 2024

Body Corporate sinking fund - QLD

- Feb, 2, 2024

Scaffolding Safety

- Sep, 20, 2023

Learning to Negotiate

- Jul, 11, 2023

Pension Age Rises to 67

- May, 18, 2023

Becoming A Registered Builder In Australia

- Apr, 17, 2023

Forced Sales - Queensland - 75% Rule

- Sep, 19, 2022

The benefits of shade sails for your home

- Jul, 27, 2022

Termite Swarmers Season

- Jun, 22, 2022

Fear of missing out driving inflation

- Apr, 28, 2022

Australia's Rental Crisis

- Mar, 7, 2022

Should you buy a home with Termite damage?

- Mar, 3, 2022

Tactics to reduce body corporate disputes

- Jan, 25, 2022

Globalisation - The Hedgehog & The Fox

- Nov, 2, 2021

Revealed: Top 10 areas to avoid buying

- Oct, 28, 2021

Is that house protected against termites?

- Sep, 15, 2021

Tree Changers & Sea Changers

- Aug, 12, 2021

COVID 19 and Body Corporate Responsibilities

- Jul, 29, 2021

Tenants beware of rental rewards schemes

- Jun, 25, 2021

Sunshine Coast versus Gold Coast

- Jun, 23, 2021

Your superannuation and your home

- Jun, 11, 2021

How many properties sit empty?

- May, 10, 2021

What Returns could I make from Property Investment

- May, 4, 2021

Real Estate Agents and Property Managers

- Apr, 20, 2021

Why You Need A Termite Inspection

- Mar, 19, 2021

SEO for Real Estate websites

- Mar, 18, 2021

Three Reasons Why Your Home Needs Data Cabling

- Mar, 16, 2021

Smoke Alarms: What you need To know in QLD

- Dec, 10, 2020

Pre-purchase Electrical Inspection

- Dec, 4, 2020

Why should I drink Adelaide Hills Wines?

- Aug, 26, 2020

Amalgamation of Strata-titled Lots for Development

- Jul, 28, 2020

Adelaide Hills a unique region

- Apr, 28, 2020

Ozone Generator in Your Home

- Apr, 21, 2020

Air conditioning cleaning

- Apr, 14, 2020

Housing Affordability in Australia

- Apr, 6, 2020

Security Systems

- Mar, 31, 2020

Termites and protecting the home

- Feb, 27, 2020

Printing for the Real Estate Industry

- Nov, 12, 2019

Beware of Property Investment Spruikers

- Oct, 31, 2019

Prices for Home Alarm Monitoring

- Oct, 9, 2019

House and Land packages best investment

- Oct, 1, 2019

The 'Scourge' of Underquoting

- Oct, 16, 2017

Professional Pest Control

- Sep, 29, 2017

Built in Wardrobes

- Jul, 9, 2015

Pool Inspections Queensland

- Jun, 25, 2015

Negotiating your purchase with the Inspection

- May, 12, 2015

DIY Move or hire a removalist company?

- Nov, 19, 2014

Why are housing prices rising faster than wages?

- Jan, 17, 2014

The Friendliest Real Estate Agents

- Jul, 23, 2013

A thorough Building and Pest Inspection

- Sep, 28, 2012

How to Compare Home Loans

- Jan, 25, 2012

Southport Real Estate