Fear of missing out driving inflation

Watching the news and seeing iceberg lettuce is going off in price all of a sudden you feel the need, you want an iceberg lettuce.

Because the news is talking about it, that is an Availability Bias and a response to that.

What we remember most vividly in our past influences our future. That's the power of personal experience.

Think toilet paper shortages caused by panic-buying (fear of missing out) during COVID. COVID added to our sense of missing out. Sadly the empty isles of supermarkets brought the worst out of some of us.

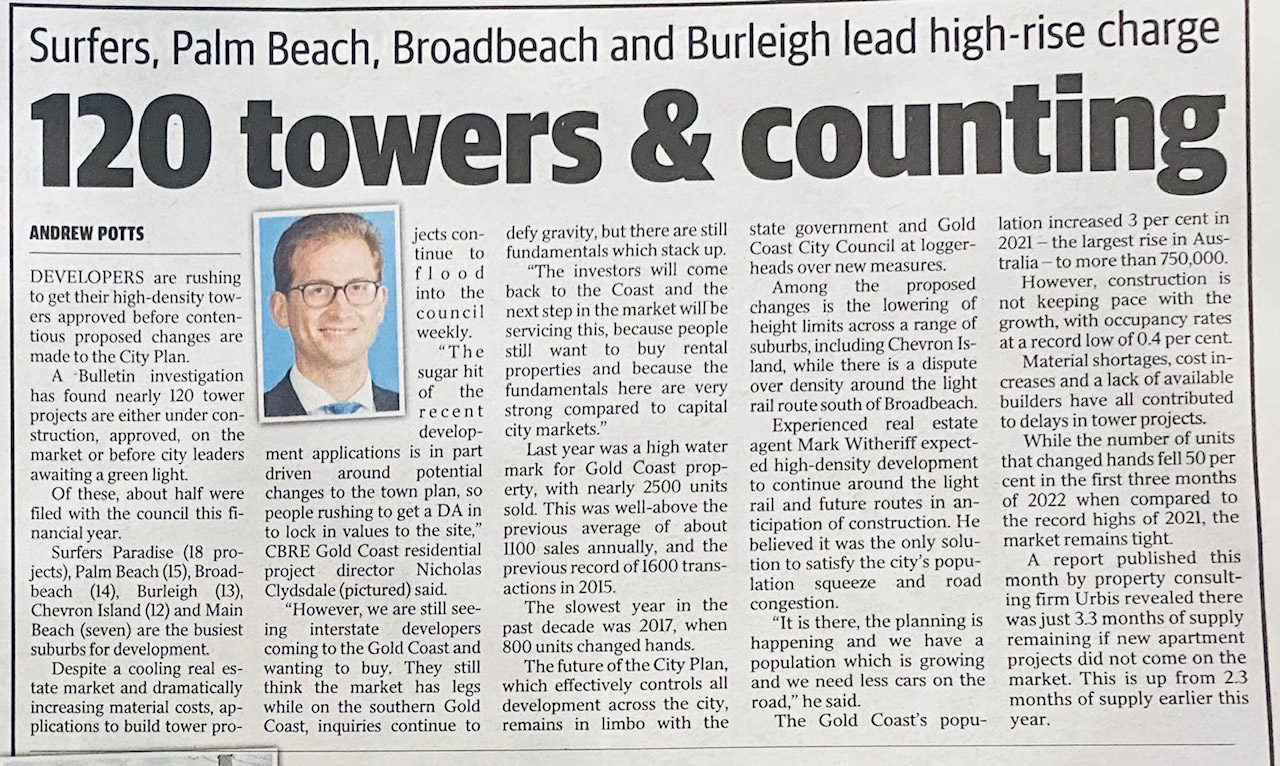

Suddenly that home near the beach on the Gold Coast took our interest.

Gold Coast had a 3% population increase in 2021 - the largest rise in Australia.

Potential changes to the Gold Coast town plan have seen developers driven by fear of missing out to harass property owners for amalgamation opportunities

However this leaves a distorted rental market. Gold Coast can't get enough hospitality workers and don't want to pay them liveable wages in a city that has extremely high rents. However to claim workers wage rises will fuel inflation ignores recent history.

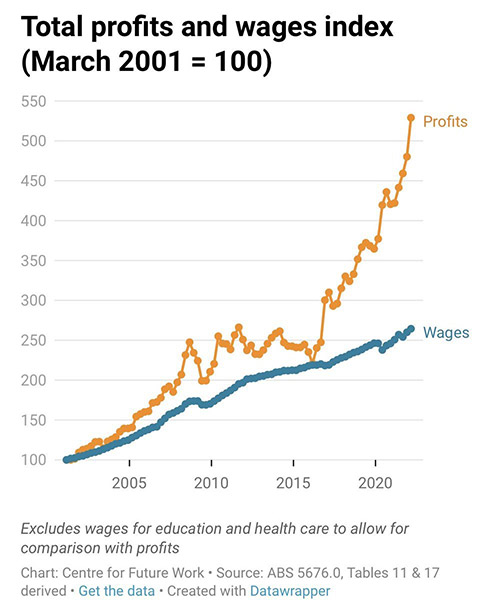

Profits not wages are feeding inflation

So can we believe Phillip Lowe's claims that Australia is unlikely to see a recession? Well, economist Jim Stanford says it doesn't stack up. He's also dismissed after those warnings against wage rises beyond three and a half percent as inflation rate. Dr. Sanford is director of the Centre for Future Work based at the progressive think tank, the Australian Institute..

ABC - Will Australia Avoid a Recession?

The Centre for Future Work is an initiative of the Australia Institute, to conduct and publish progressive economic research on work, employment, and labour markets.

An old stereotype leftover from the 1970s that inflation starts in the labour market because workers demand too much money and then companies have no choice left to pass on higher prices, has nothing to do with the current inflation situation.

Wages have been weak, historically weak for almost a decade, including right now, even with the unemployment rate at 3.9%. The latest data we have on wages are growing at 2.4% over the last year, that's less than half the rate of inflation.

Business profits in Australia are higher as a share of GDP than they've ever been. So real wages are actually falling even though the unemployment rate is quite low. So this is more of a profit price problem.

The reason business profits rise is because they have pricing power. Take the energy market as an obvious example. Australia appears to have sleep-walked into an energy crisis whilst not moving quickly enough on renewables. Gas which we have in abundance, pricing is tied to world markets without an adequate reserve built in for the current emergency.

Inflationary problems are being caused by excessive profits. At the cost of workers. Dark hints that workers may be too greedy abound.

Inflation Psychology

The urge to buy more products or cheaper products (fear of missing out) and buy now before prices go up is also fuelling inflation.

Another bias - the scarcity bias appears when things are in short supply.

Hence Reserve Bank Governor Phillip Lowe fears -:

Phillip Lowe has warned that so called inflation psychology could take hold and if it does, it prolongs inflation and make it harder to control.

ABC - Will Australia Avoid a Recession?

The impact of inflation of first home buyers can be severe.

JOMO - Joy of Missing Out

The Joy of Missing Out is an antedote to the "shoulds" and "wants" that encompas fear of missing out. Being present and enjoying what you have is encouraged by physcologists, counsellors and Yoga Teachers alike.

What is being present?

Being present is about not being mentally absent. Being in the here and now.

SEARCH ARTICLES

Recent Posts

- Jul, 22, 2025

Who is responsible for that water leak?

- May, 6, 2025

Diversity on Boards

- Apr, 11, 2025

When does asbestos become dangerous in your home?

- Jan, 23, 2025

How Design Aesthetics Shape Perceived Value

- Dec, 10, 2024

Impact of Inflation on First-Time Buyers

- Nov, 4, 2024

How to understand and check your credit score

- Sep, 19, 2024

Buying off the plan? Beware of sunset clauses

- Jul, 5, 2024

Essential Workers Explained

- Jun, 13, 2024

Ozone Generators to remove Mould

- Feb, 19, 2024

Massive tax handouts for property investors

- Feb, 16, 2024

Body Corporate sinking fund - QLD

- Feb, 2, 2024

Scaffolding Safety

- Sep, 20, 2023

Learning to Negotiate

- Jul, 11, 2023

Pension Age Rises to 67

- May, 18, 2023

Becoming A Registered Builder In Australia

- Apr, 17, 2023

Forced Sales - Queensland - 75% Rule

- Dec, 6, 2022

Petty Landlords & Negative Gearing

- Sep, 19, 2022

The benefits of shade sails for your home

- Jul, 27, 2022

Termite Swarmers Season

- Apr, 28, 2022

Australia's Rental Crisis

- Mar, 7, 2022

Should you buy a home with Termite damage?

- Mar, 3, 2022

Tactics to reduce body corporate disputes

- Jan, 25, 2022

Globalisation - The Hedgehog & The Fox

- Nov, 2, 2021

Revealed: Top 10 areas to avoid buying

- Oct, 28, 2021

Is that house protected against termites?

- Sep, 15, 2021

Tree Changers & Sea Changers

- Aug, 12, 2021

COVID 19 and Body Corporate Responsibilities

- Jul, 29, 2021

Tenants beware of rental rewards schemes

- Jun, 25, 2021

Sunshine Coast versus Gold Coast

- Jun, 23, 2021

Your superannuation and your home

- Jun, 11, 2021

How many properties sit empty?

- May, 10, 2021

What Returns could I make from Property Investment

- May, 4, 2021

Real Estate Agents and Property Managers

- Apr, 20, 2021

Why You Need A Termite Inspection

- Mar, 19, 2021

SEO for Real Estate websites

- Mar, 18, 2021

Three Reasons Why Your Home Needs Data Cabling

- Mar, 16, 2021

Smoke Alarms: What you need To know in QLD

- Dec, 10, 2020

Pre-purchase Electrical Inspection

- Dec, 4, 2020

Why should I drink Adelaide Hills Wines?

- Aug, 26, 2020

Amalgamation of Strata-titled Lots for Development

- Jul, 28, 2020

Adelaide Hills a unique region

- Apr, 28, 2020

Ozone Generator in Your Home

- Apr, 21, 2020

Air conditioning cleaning

- Apr, 14, 2020

Housing Affordability in Australia

- Apr, 6, 2020

Security Systems

- Mar, 31, 2020

Termites and protecting the home

- Feb, 27, 2020

Printing for the Real Estate Industry

- Nov, 12, 2019

Beware of Property Investment Spruikers

- Oct, 31, 2019

Prices for Home Alarm Monitoring

- Oct, 9, 2019

House and Land packages best investment

- Oct, 1, 2019

The 'Scourge' of Underquoting

- Oct, 16, 2017

Professional Pest Control

- Sep, 29, 2017

Built in Wardrobes

- Jul, 9, 2015

Pool Inspections Queensland

- Jun, 25, 2015

Negotiating your purchase with the Inspection

- May, 12, 2015

DIY Move or hire a removalist company?

- Nov, 19, 2014

Why are housing prices rising faster than wages?

- Jan, 17, 2014

The Friendliest Real Estate Agents

- Jul, 23, 2013

A thorough Building and Pest Inspection

- Sep, 28, 2012

How to Compare Home Loans

- Jan, 25, 2012

Southport Real Estate