Housing Affordability in Australia

The great Australian dream is to own our own home.

One of the major issues facing Australians is "housing affordability", especially for first home buyers.

Susan Lloyd-Hurwitz - Chair of the National Housing Supply and Affordability Council in a National Press Club of Australia address Sep 4th 2024 identified 5 areas of immediate focus-:

1 we need to have adequate investment in social housing

2 we must commit to best practice learning and planning systems across the country

3 we need to build more capacity in the construction sector

4 we need a better system for renters

5 we need to work work towards policy settings that are well coordinated across all levels of government

Alan Kohler, writing in the quarterly essay, contends that Australia has been divided into those own house and those who don't, and those whose families have housing will pass on to their children and those who don't.

Renters in the private market have experienced a sharp rise in rent, almost 40% since January 2020. Paying the rent now consumes a record 32% of household income on average.

In Australia our whole superannuation system is predicated on you owning your home. We can find a study that says negative gearing is neutral, it's bad or it's good.

Non reputable developers are a considerable structural constraint on the system. To gain finance for a development off-the-plan pre-sales are required. Developers who routinely file for bankruptsy cause a mistrust of developers/developments for those who would do the right thing. Developers who aggressively harass people for sought after locations do nothing for the housing crisis.

The Housing Accord includes an initial aspirational target agreed by all parties to build one million new well‑located homes over 5 years from mid‑2024.

source: Susan Lloyd-Hurwitz - Chair of the National Housing Supply and Affordability Council in a National Press Club of Australia address Sep 4th 2024

In the middle of the decade (2014-2015), one in every 7 tax-payers owned a rental property. First home buyers found themselves competing with investors who were utilising Australia's negative gearing laws and foreign investors who were attracted to the Australian Real Estate market.

Foreign Ownership

Foreigners are permitted to purchase new properties (apartments and houses) but generally not permitted to buy established dwellings. The intention is for foreign investment in new and 'off-the-plan' sales to keep the Australian housing construction industry (jobs and the economy) strong and a consistent flow of Australian housing and apartment stocks to come onto the market.

However, even the rules surrounding the buying of 'established dwellings' contains loopholes in relation to the families of international students enrolled in Australian institutions being permitted to purchase established homes for the duration of their children's study in Australia.

Foreign and local investor demand increases prices and their demand for housing puts upward pressure on the price of houses in Australia.

Negative Gearing

Negative Gearing has been around since 1922 – it is where a property investor is allowed to claim losses on their 'investment' against their taxable income, thus making investing attractive. It started as a way to encourage housing development.

A million and a quarter Australian investors benefit from negative gearing. The tax breaks cost the government billions of dollars a year in lost revenue and critics say that negative gearing pushes up the price of houses making it even harder for first home buyers. So is it time to get rid of negative gearing or would it cause a major contraction in rental properties?

ABC Life matters with Peter Martin Economics Editor, The Age. 19-11-2014

Housing Affordability - a definition

In 2015, it was determined by a government committee that housing affordability was out of the reach of many if not most Australians, especially first home buyers. A new definition for 'housing affordability' needed to be created to facilitate better housing policy decisions.

housing that is owned and managed by community organisations, state owned public housing or housing that costs not more than 30% of the income of households on the lowest 40% of the income scale'. The Council recommended that federal and state governments 'develop a universal definition that describes what type of housing and income groups fall within affordable housing'.

(The Australian housing affordability challenge - Economics References Committee, May 2015.)

In May 2016, it was announced that 3 out of 4 major Australian banks would no longer lend to foreigners.

This had the potential to cause major issues in our housing market.

If purchasers cannot get funding to settle the units for which they have signed a contract, the bank that lent funds for the development to proceed may press the developer to sell at 'firesale' prices.

Source: Bloomberg

On the other hand, a drop in foreign investors in the Australian housing market had the potential to make housing more affordable for Australians, especially first home buyers.

Fast Forward to 2020

In January 2020, Euan Black noted:

The window of opportunity for first-home buyers is slamming shut, as interest rate cuts and looser bank lending reflate Australia's housing bubble. A significant increase in people's borrowing capacity saw national property prices jump 4 per cent over the December quarter.

And while there are signs the market has eased its foot off the gas pedal, the prospect of further interest rate cuts in 2020 suggest prices will continue to soar.

It's therefore reasonable to expect that first-home buyers will once again be priced out of the market. In fact, this is what the latest round of ABS lending data appears to be telling us.

For while first-home buyers still represented a substantial proportion (29.7 per cent) of owner-occupier home loans in November 2019, their share of the pie is gradually shrinking.

The number of loan commitments to first-home buyers fell 0.9 per cent in November and 0.4 per cent in October, marking the first back-to-back fall since January 2019.

The value of loans to first-home buyers increased 2.1 per cent in November, to reach its highest level since October 2009. But this just shows fewer first-home buyers are taking on ever larger mortgages.

Which is perhaps unsurprising, given national prices last year recorded their fastest quarterly growth rate since November 2009.

https://thenewdaily.com.au/finance/property/2020/01/18/first-home-buyer-woes/

A Brief Glimmer of Hope

Black maintains the rapid gains came after a significant market correction had temporarily offered first-home buyers a glimmer of hope.

Over a 21-month period, national property prices had fallen 8.4 per cent.

The country's median dwelling price was seven times higher than the median income in early 2018 and according to CoreLogic, "such a fall was great news for first-home buyers struggling to save a deposit."

And property journalist, Samantha Landy, pointed out that "upsizers, downsizers and first home buyers tend to stay in their local area [because] they build up networks over time, whether it be family, friends, schooling, even down to the local doctor and shopping centre."

(S. Landy. Staying Local. The Herald-Sun. 21 March 2020)

Black observed:

Tighter bank lending triggered the price falls. Australia's financial regulator, APRA, introduced policies aimed at reducing investor activity in 2017, and the banking royal commission forced lenders to act more scrupulously.

The pace of price declines began to ease towards the end of 2018 and into the early months of 2019.

And then the Reserve Bank and APRA kicked the market into overdrive.

Cheap money and looser lending

First, the RBA dropped interest rates in June for the first time since September 2016. And then APRA lowered the hypothetical interest rate that banks must use to determine a borrower's creditworthiness.

Modelling by BIS Oxford Economics at the time found the average buyer's borrowing capacity jumped 11 per cent after APRA's changes, enabling buyers to bid up prices.

And another RBA rate cut in October added fuel to the fire.

Warren Hogan, independent economist and industry professor at UTS Business School, told The New Daily in November that the RBA had tossed away all the good work the recent correction had achieved by cutting rates in October.

"This rate of recovery that we've seen over the past few months will see us go back to the peaks of the market in Sydney and Melbourne before the middle of next year," he said.

What's more, lower rates not only inflate asset prices, they reduce the interest first-home buyers earn on their savings accounts.

This makes it even harder to save a deposit, at a time when annual wages growth has fallen to just 2.2 per cent.

The alternatives

The only way to really help first-home buyers is to reduce the overall demand for housing by scrapping negative gearing and capital gains tax discounts.

But the government has shown little appetite for such changes. And neither, perhaps, have voters.

https://thenewdaily.com.au/finance/property/2020/01/18/first-home-buyer-woes/

Another Twist - Covid-19

"The Covid-19 pandemic presents a situation unlike any we have experienced before. Around the world, financial markets, businesses and the social rhythms of daily life have been turned upside down...

Millions of people use realestate.com.au when buying and selling property...

We are releasing new features to adapt to today's market conditions.

Our new "Digital Inspections' feature will be available on 26 March allowing open-for-inspections to continue without missing a beat - and without the need to leave your home if desired."

(Full Page Advertisement -- realestate.com.au - 21 March 2020)

Analysts were expecting double-digit annual growth before the onset of COVID-19.

22nd March 2020 - Australian Prime Minister, Scott Morrison, announces new measures and restrictions to protect the Australian community from the spread of corona virus (COVID-19) during the global pandemic.

A 'temporary' ban on in-room and on-site auctions forced real estate agents across the country to move online.

It was predicted that the Australian property market could take a "major hit" as property sellers considered withdrawing homes from sale during the corona virus lockdowns.

"Would-be sellers are rethinking plans to list their homes, while those with properties on the market face the possibility of cancelled auctions..."

(S. Landy. J. Smiles. Vendor's virus chills. Herald-Sun. 22 March 2020)

However, Australia's largest online property listing business, realestate.com.au, adapted quickly to the changed circumstances by offering digital online home inspections.

On 29th March, Landy observed that Australian property auction markets had also adapted swiftly with "purpose built streaming and bidding platforms, as well as video-conferencing apps..."

As agents, sellers and buyers adapted to online only auctions it was hoped that the small proportion of auctions that actually went ahead from those originally scheduled in the first week of the new lockdown measures, would increase over the coming weeks - provided lockdown measures did not become even more extreme.

Less than one week later, Euan Black reported the following:

Auction markets continue to struggle after recording worst result since 2008

Almost one in two homes (45 per cent) were withdrawn from sale this week as the corona virus continued to weigh on activity.

The majority of sales were conducted privately as vendors shunned the world of online auctions - and fewer than half of the sales captured by CoreLogic were successful.

The preliminary clearance rate across the capital cities subsequently came in at 48 per cent, according to the property analytics firm.

But that number will likely be revised down in the coming days as more results and withdrawals are accounted for.

...some economists now believe the virus could trigger a large enough rise in unemployment to slash prices by up to 20 per cent.

https://thenewdaily.com.au/finance/property/2020/04/05/coronavirus-auction-collapse/

While property prices may drop by up to 20%, the ability for potential buyers, especially first home buyers, to enter the property market has been severely eroded (or completely sabotaged) due to the vast loss of incomes and/or loss of jobs for many Australians in the months or perhaps years ahead, owing to the Covid-19 global pandemic.

We are currently in totally unknown territory regarding the Aussie dream of owning a home.

Fast Forward to 2024

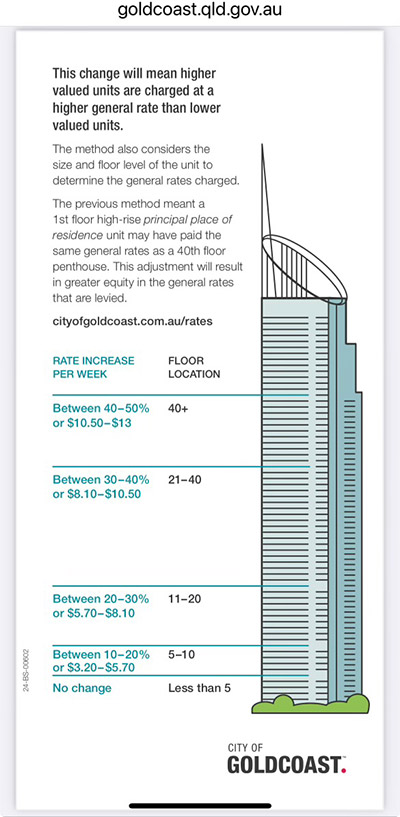

The rhetoric of "building up not out" has dealt a harsh reality to popular regional locations like Gold Coast.

Gold Coast City Council having appeared to 'approve just about anything' and consequently over-developed the beach-side suburbs, made a 'harsh' change to rates for those "downsizing" to a unit.

Mr Van Dam, in a Chevron Island apartment, said he was stunded to see his bill on Tuesday had gone up by 20 per cent.

Other apartment owners have been slugged with rises as high as 50 per cent, with people paying more depending what floor they are on,

Keith Woods Gold Coast Bulletin - Stunning highrise rate hike Thur July 25, 2024

SEARCH ARTICLES

Recent Posts

- Jul, 22, 2025

Who is responsible for that water leak?

- May, 6, 2025

Diversity on Boards

- Apr, 11, 2025

When does asbestos become dangerous in your home?

- Jan, 23, 2025

How Design Aesthetics Shape Perceived Value

- Dec, 10, 2024

Impact of Inflation on First-Time Buyers

- Nov, 4, 2024

How to understand and check your credit score

- Sep, 19, 2024

Buying off the plan? Beware of sunset clauses

- Jul, 5, 2024

Essential Workers Explained

- Jun, 13, 2024

Ozone Generators to remove Mould

- Feb, 19, 2024

Massive tax handouts for property investors

- Feb, 16, 2024

Body Corporate sinking fund - QLD

- Feb, 2, 2024

Scaffolding Safety

- Sep, 20, 2023

Learning to Negotiate

- Jul, 11, 2023

Pension Age Rises to 67

- May, 18, 2023

Becoming A Registered Builder In Australia

- Apr, 17, 2023

Forced Sales - Queensland - 75% Rule

- Dec, 6, 2022

Petty Landlords & Negative Gearing

- Sep, 19, 2022

The benefits of shade sails for your home

- Jul, 27, 2022

Termite Swarmers Season

- Jun, 22, 2022

Fear of missing out driving inflation

- Apr, 28, 2022

Australia's Rental Crisis

- Mar, 7, 2022

Should you buy a home with Termite damage?

- Mar, 3, 2022

Tactics to reduce body corporate disputes

- Jan, 25, 2022

Globalisation - The Hedgehog & The Fox

- Nov, 2, 2021

Revealed: Top 10 areas to avoid buying

- Oct, 28, 2021

Is that house protected against termites?

- Sep, 15, 2021

Tree Changers & Sea Changers

- Aug, 12, 2021

COVID 19 and Body Corporate Responsibilities

- Jul, 29, 2021

Tenants beware of rental rewards schemes

- Jun, 25, 2021

Sunshine Coast versus Gold Coast

- Jun, 23, 2021

Your superannuation and your home

- Jun, 11, 2021

How many properties sit empty?

- May, 10, 2021

What Returns could I make from Property Investment

- May, 4, 2021

Real Estate Agents and Property Managers

- Apr, 20, 2021

Why You Need A Termite Inspection

- Mar, 19, 2021

SEO for Real Estate websites

- Mar, 18, 2021

Three Reasons Why Your Home Needs Data Cabling

- Mar, 16, 2021

Smoke Alarms: What you need To know in QLD

- Dec, 10, 2020

Pre-purchase Electrical Inspection

- Dec, 4, 2020

Why should I drink Adelaide Hills Wines?

- Aug, 26, 2020

Amalgamation of Strata-titled Lots for Development

- Jul, 28, 2020

Adelaide Hills a unique region

- Apr, 28, 2020

Ozone Generator in Your Home

- Apr, 21, 2020

Air conditioning cleaning

- Apr, 6, 2020

Security Systems

- Mar, 31, 2020

Termites and protecting the home

- Feb, 27, 2020

Printing for the Real Estate Industry

- Nov, 12, 2019

Beware of Property Investment Spruikers

- Oct, 31, 2019

Prices for Home Alarm Monitoring

- Oct, 9, 2019

House and Land packages best investment

- Oct, 1, 2019

The 'Scourge' of Underquoting

- Oct, 16, 2017

Professional Pest Control

- Sep, 29, 2017

Built in Wardrobes

- Jul, 9, 2015

Pool Inspections Queensland

- Jun, 25, 2015

Negotiating your purchase with the Inspection

- May, 12, 2015

DIY Move or hire a removalist company?

- Nov, 19, 2014

Why are housing prices rising faster than wages?

- Jan, 17, 2014

The Friendliest Real Estate Agents

- Jul, 23, 2013

A thorough Building and Pest Inspection

- Sep, 28, 2012

How to Compare Home Loans

- Jan, 25, 2012

Southport Real Estate